Nobody enjoys working with their insurance company. We know, we help our customers file their claim and work with their agents all the time. It’s one of the key things that makes us unique. Because of this experience, we’ve learned a thing or two about insurance terminology and how it affects your claim or claim potential.

Looking through our archive of frequently asked questions, here’s one that we hear a lot: Why does my insurance claim talk about depreciation and what does it mean?

To help our clients be more prepared when a disaster strikes, here’s the top five things you need to know about depreciation and how it can affect your claim.

Top 5 Things To Know About Depreciation

- What is Depreciation? Insurance policies vary in how they address the issue of depreciation. You may hear the terms “recoverable depreciation” and “non-recoverable depreciation.” Essentially, recoverable depreciation is lost value that can be restored by repairs or renovations.

- How Do I Get Reimbursed For Damaged Items? This can be a little bit tricky but generally speaking, depreciation claims start with the ACV (Actual Cash Value) of a good or item at the time it’s been destroyed.

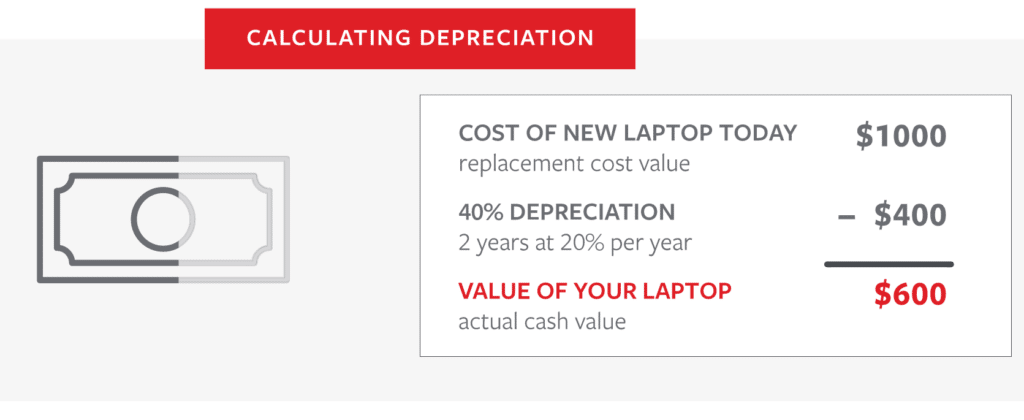

- How is Depreciation Calculated? Generally speaking, depreciation looks at the RCV (Replacement Cost Value) of your lost item (or home/property) and compares it to the age of your property or items at the time of loss.

- How Long Do I Have To Decide About Replacing An Item? Every insurance company varies but the general suggestion is to notify your insurance company within 6 months to make sure your claim is eligible.

- Am I Guaranteed A Claim Or Return? There are no guarantees in the world of insurance. It’s always best to check with your specific insurance provider to see what the terms and rules are surrounding depreciation on your policy.

Here’s an example of a laptop from #3 showing its loss of value over time and how that compares to its RCV (replacement cost value):

While Distinctive Restoration is not an insurance provider or company we do work with our clients on a regular basis to help them understand the appropriate claims to file and where to start. If you find yourself in a home disaster situation, give us a call. We’re here to help and will do our best to provide solid advice and information. Please note, this blog is purely for informational purposes and is not a replacement for speaking directly with your insurance representative about your unique situation.